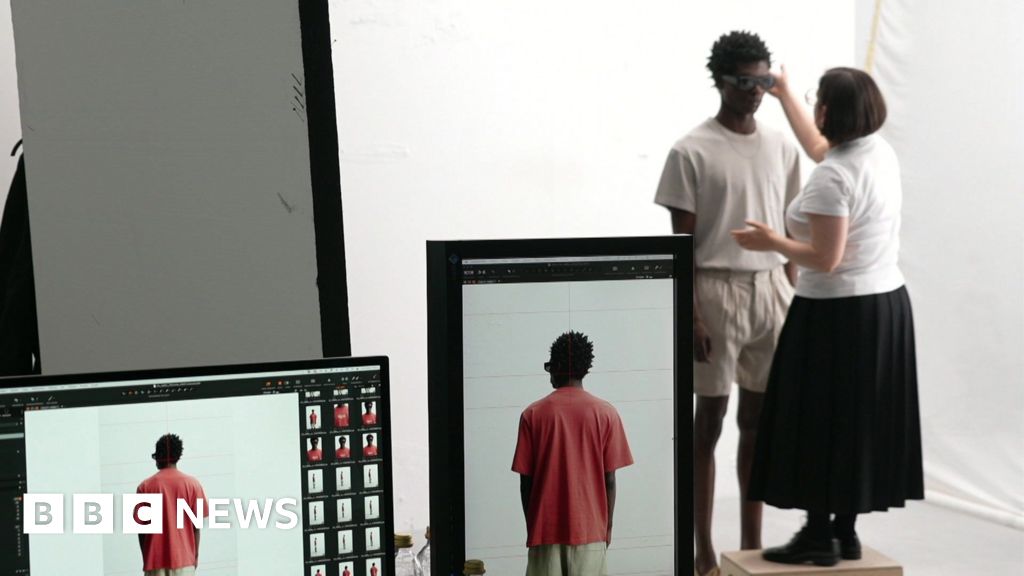

It's going to be a very sexy summer, a touch of romantic, cowboy and rock and roll. That's according to Mehdi Sousanne, at least. And he should know. He's a designer for Zara who helps create the clothes for a brand that's one of the most successful stories in High Street fashion. Zara is owned by Inditex, the world's biggest fashion retailer, which runs a string of store chains including Massimo Dutti and Pull & Bear. It relies on 1,800 suppliers across the world, but nearly all the clothes are brought to Spain where the company is based, to be despatched to stores in 97 countries. Zara doesn't advertise and rarely gives interviews. But as it marks 50 years since the opening of its first store, I've come to its vast campus in Galicia to meet the boss and workers for a rare glimpse into how the secretive brand operates. It's a time when the company finds itself having to navigate fast-changing markets, with growing competition from ultra-cheap online players Shein and Temu, who ship their goods direct from China, as well as uncertainty surrounding US tariffs. But Oscar Garcia Maceiras, Inditex's CEO, says US President Donald Trump's tariffs won't disrupt its supply chains or change Zara's plans to expand further in the US, now its second biggest market. "Bear in mind that for us, diversification is key. We are producing in almost 50 different markets with non-exclusive suppliers so we are more than used to adapt ourselves to change," he tells me. The business has certainly adapted and grown since its first store opened a short drive away in the town of A Coruna. It now has 350 designers, with the staff coming from some 40 different countries. "There are no rules in general. It's all about feelings," says Mehdi, who works on delivering the key pieces for the season. He says inspiration can come from anyone ranging from the "street" to the cinema as well as the catwalks. He likes to sketch his ideas once an all-important mood board has been created. In the pattern cutting room, the designs are turned into paper samples, and are pinned on to mannequins. Dozens of seamstresses then run up the first fabric samples on the spot for a first fitting. Pattern maker Mar Marcote has been with the business 42 years and still uses a magnifying glass to examine each item of clothing before it finally goes into production. "When you finish the item and see that it looks good, and then sometimes sells out, it's marvellous," she says. Zara is a business that has changed the way we shop. In the old days, retailers released just two main collections a year, Spring/Summer and Autumn/Winter. For decades, most chains have outsourced manufacturing to lower-cost factories in the far east with the clothes arriving up to six months later. Zara went against conventional wisdom by sourcing a lot of its clothes closer to home and changing products much more frequently. That meant it could respond much faster to the latest trends and drop new items into stores every week. Just over half of its clothes are made in Spain, Portugal, Morocco and Turkey. There's a factory doing small production runs on site at HQ, with another seven nearby, which it also owns. As a result, it can turn around products in a matter of weeks. More basic fashion staples are produced with longer lead times in countries like Vietnam and Bangladesh. Logistics and data are other factors behind its success. Every piece of clothing is packaged and despatched from its distribution centres in Spain, as well as one in the Netherlands. "What is absolutely critical is the level of accuracy," says CEO Mr Maceiras. "It's something that allows us to make the right decision in the last possible minute, in order to assess properly the appetite from our customers, in order to adapt our fashion proposition to the profile of our customers in different locations." In other words, getting the right products to the right shops. At HQ, product managers then receive real-time data on how clothes are selling in stores worldwide, and – crucially – feedback from customers, which is then shared with designers and buyers, who can adjust the ranges along the season according to demand. Unlike some other High Street rivals, it only discounts when it stages its twice-yearly sales. But is Zara starting to lose its shine after posting slower sales growth at the start of this year? "The key challenge for Inditex is continuing to be relevant in a fashion world that continues to get faster and cheaper," says William Woods, European retail analyst for Bernstein. Not only are mainstream rivals like H&M, Mango and Uniqlo trying to catch up, the market has been disrupted by Shein and Temu. Shein racked up $38bn in global sales last year, just a whisker behind Inditex. Asked how much of a threat Shein and Temu's success poses to Zara, Mr Maceiras stresses that its business model doesn't rely on price. "Of course, we are looking at providing our customers our products at an affordable price. But for us, it's critical to provide customers fashion that should be inspirational, with quality, creativity and sustainable." Zara has come a long way since its founder Amancio Ortega started the business. The company is still majority-owned by his family and his daughter Marta is now chairwoman of the group. Now aged 89, Mr Ortega remains famously reclusive but still pops in, according to Mr Maceiras. "He's a presence, a physical or moral presence, absolutely every day."

Inside the secretive world of Zara

TruthLens AI Suggested Headline:

"Zara Marks 50 Years of Fashion Innovation Amidst Evolving Market Challenges"

TruthLens AI Summary

Zara, a leading name in fast fashion, celebrates 50 years since the opening of its first store, showcasing its unique approach to clothing production and retail. The brand operates under Inditex, the world's largest fashion retailer, which oversees several other chains, including Massimo Dutti and Pull & Bear. Notably, Zara does not engage in traditional advertising or frequent interviews, opting instead for a business model that emphasizes rapid adaptation to market trends. Despite facing increasing competition from ultra-cheap online retailers like Shein and Temu, as well as uncertainties surrounding tariffs, Zara's CEO, Oscar Garcia Maceiras, remains confident in the company's resilience and plans for expansion, particularly in the U.S., which is now its second-largest market. He highlights the importance of diversification, noting that Zara sources materials from nearly 50 different markets, allowing for flexibility in their supply chain operations.

The design process at Zara is notably dynamic and collaborative, involving 350 designers from diverse backgrounds who draw inspiration from various sources, including street fashion and cinema. This creativity is transformed into tangible products through a meticulous process that includes sketching, pattern cutting, and rapid prototyping, enabling Zara to introduce new items to stores weekly. Over half of Zara's clothing is produced in nearby countries such as Spain, Portugal, Morocco, and Turkey, which facilitates quick turnaround times compared to traditional retailers that rely on longer production cycles in distant factories. Furthermore, Zara's success is bolstered by sophisticated logistics and real-time data analytics that inform product managers about sales performance and customer feedback, allowing for timely adjustments in inventory. Although Zara has posted slower sales growth recently, industry analysts note that its challenge lies in maintaining relevance in an increasingly fast-paced and price-sensitive fashion landscape. Maceiras asserts that Zara's focus remains on providing quality, creativity, and an inspirational shopping experience rather than solely competing on price, a philosophy that has shaped its enduring success in the fashion industry.

TruthLens AI Analysis

The article provides a rare insight into Zara, a major player in the fast fashion industry, as it celebrates its 50th anniversary. It highlights the company's unique operational model, its ability to adapt to market changes, and the creative processes behind its clothing designs. By emphasizing Zara's success and resilience, the piece aims to shape public perception positively, showcasing the brand as innovative and responsive to consumer trends.

Brand Image and Perception

The narrative promotes Zara's image as an agile and trend-setting brand. By not relying on traditional advertising and focusing instead on design creativity and consumer engagement, the article positions Zara as a leader in high street fashion. The mention of its diverse workforce and the creative process suggests a modern, inclusive approach, which can enhance consumer loyalty and attract fashion-conscious shoppers.

Potential Hidden Agendas

While the article paints a positive picture of Zara, it may downplay some of the industry's challenges, such as sustainability issues and labor practices within its supply chain. By focusing on the brand's successes and creative processes, there is a risk of obscuring the less favorable aspects of fast fashion, which could leave readers with an incomplete understanding of the brand's impact on the environment and society.

Manipulative Elements

The tone of the article is inherently flattering towards Zara and Inditex, potentially creating a bias in how readers perceive the brand. By celebrating its innovative practices while glossing over criticisms, the article could be seen as manipulative in its portrayal of the company. This selective narrative may lead readers to view Zara as a responsible and forward-thinking brand without acknowledging the complexities involved in the fast fashion model.

Comparison with Other News

In the broader context of news about retail and fashion, this article contributes to a growing narrative that emphasizes resilience and adaptability in the face of market changes. It aligns with other articles discussing the challenges faced by traditional retailers against online competitors, highlighting Zara's strategies to maintain relevance.

Impact on Society and Economy

The portrayal of Zara's expansion plans and resilience in the face of competition could instill a sense of confidence in investors and consumers alike. If Zara continues to thrive, it might influence market trends, potentially leading to increased competition among retailers. This could impact employment in the fashion sector and affect consumer spending patterns, particularly in the fast fashion segment.

Target Audience

The article likely appeals to fashion enthusiasts, potential investors, and consumers interested in the dynamics of the retail industry. By focusing on Zara's design process and market strategies, it seeks to engage readers who are curious about fashion and retail trends.

Market Influence

This article could have implications for stock prices related to Zara's parent company, Inditex, especially as it discusses expansion plans and market resilience. Investors may view Zara's adaptability as a positive indicator of future performance, influencing their investment decisions.

Connection to Global Dynamics

While the article primarily focuses on Zara's brand narrative, it also touches upon broader economic factors, such as tariffs and competition from international players like Shein and Temu. This context situates Zara within a global framework, indicating its relevance in discussions about global trade and consumer behavior.

Use of AI in Reporting

It is possible that AI tools were employed in drafting the article, particularly in data analysis or generating insights based on trends. However, the narrative style suggests a human touch in crafting the story, focusing on emotional appeal and brand storytelling, which AI may not fully replicate.

In summary, the article presents a largely positive view of Zara while potentially omitting critical perspectives on the fast fashion industry. The portrayal of innovation and adaptability aims to foster a favorable public image, though it may also lead to a skewed understanding of the brand's broader impact.