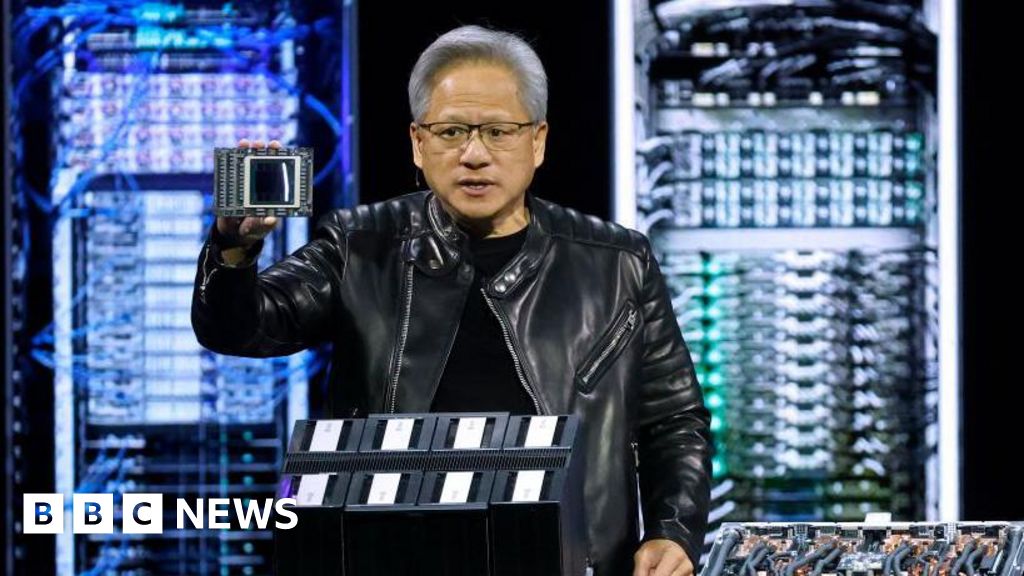

Shares in Nvidia plunged on Wednesday after the computer chip giant said it would be hit by $5.5bn (£4.2bn) in costs due to the US government tightening its export rules to China. The firm, which has been at the heart of the artificial intelligence (AI) boom, will require licences to export its H20 AI chip to China, which has been one of its most popular. The rules come as part of an escalating trade war between the US and China, with both countries introducing steep trade tariffs on each other covering various goods. Nvidia shares fell almost 7% on Wednesday. The Nasdaq exchange it is listed on ended the day down 3.1%. The company announced on Tuesday that the US government had told it last week that the H20 chip required a permit to be sold to China, including Hong Kong. The tech giant said federal officials had advised them the licence requirement "will be in effect for the indefinite future". "The [government] indicated that the license requirement addresses the risk that the covered products may be used in, or diverted to, a supercomputer in China," Nvidia said. The company declined to comment further when contacted by the BBC. Marc Einstein from the Counterpoint Research consultancy said the $5.5bn hit estimated by Nvidia was in line with his estimates. But he said "while this is certainly a lot of money, this is something Nvidia can bear". "As we have seen in the last few days and weeks, this may largely be a negotiating tactic. I wouldn't be surprised to see some exemptions or changes made to tariff policy in the near future, given this not only impacts Nvidia but the entire US semiconductor ecosystem," Mr Einstein added. Chips remain a battleground in the US-China race for tech supremacy, and US President Donald Trump now wants to turbocharge a highly complex and delicate manufacturing process that has taken other regions decades to perfect. Nvidia's AI chips have been a key focus of US export controls. Founded in 1993, it was originally known for making the type of computer chips that process graphics, particularly for computer games. Long before the AI revolution, it started adding features to its chips that it says help machine learning. It is now seen as a key company to watch to see how fast AI-powered tech is spreading across the business world. The company's value took a hit in Januarywhen it was reported that a rival Chinese AI app, DeepSeek, had been built at a fraction of the cost of other chatbots. At the time, the US was considered to have been caught off guard by their rival's technological achievement. Nvidia said its $5.5bn charges would be associated with H20 products for inventory, purchase commitments and related reserves. Rui Ma, founder of the Tech Buzz China podcast, said she expects the US and China AI semiconductor supply chains to be "fully decoupled" if restrictions stay in place. She added: "It doesn't make any sense for any Chinese customer to be dependent on US chips" especially since there is an oversupply of data centres in China.

Nvidia shares plunge amid $5.5bn hit over export rules to China

TruthLens AI Suggested Headline:

"Nvidia Faces $5.5 Billion Impact from New U.S. Export Restrictions to China"

TruthLens AI Summary

Nvidia experienced a significant decline in its stock value on Wednesday, with shares dropping nearly 7% following the announcement that the company anticipates a $5.5 billion hit due to new U.S. export restrictions to China. The U.S. government has mandated that Nvidia will require licenses to export its H20 AI chip to China, a crucial market for the company amid the ongoing trade tensions between the U.S. and China. This situation highlights the escalating conflict, as both nations have imposed heavy tariffs on each other's goods. The Nasdaq exchange, where Nvidia is listed, also felt the impact, closing down 3.1% for the day. Nvidia disclosed that it was informed by federal officials that the license requirement would be in effect indefinitely, emphasizing that the restrictions are intended to mitigate the risk of the covered products being used in supercomputers in China. Despite the substantial financial implications, Nvidia has refrained from making further comments on the situation.

TruthLens AI Analysis

The recent news about Nvidia's stock plunge due to U.S. export restrictions on AI chips to China highlights the escalating tensions in the global tech and trade landscape. This development is not just a financial setback for Nvidia but also a reflection of the broader geopolitical struggle between the U.S. and China over technological dominance.

Economic and Geopolitical Implications

The $5.5 billion hit to Nvidia underscores the fragility of the semiconductor supply chain and the vulnerability of tech giants to political decisions. The U.S. government's move to restrict exports of advanced AI chips like the H20 to China is part of a larger strategy to curb China's advancements in supercomputing and AI. This aligns with the ongoing trade war, where both nations are imposing tariffs and export controls to protect their interests.

Market Reactions and Industry Impact

Nvidia's 7% stock drop and the broader Nasdaq decline of 3.1% signal investor concern over the long-term implications of these restrictions. While analysts like Marc Einstein suggest Nvidia can absorb the financial blow, the uncertainty around "indefinite" licensing requirements creates volatility. The ripple effects could extend to other semiconductor firms and the broader tech ecosystem, as companies reliant on Nvidia's chips may face disruptions.

Manipulation and Narrative Analysis

The framing of this news emphasizes the U.S.-China rivalry, potentially diverting attention from other critical issues, such as domestic semiconductor shortages or alternative markets Nvidia might explore. The language used—phrases like "supercomputer risk" and "indefinite future"—reinforces a narrative of China as a strategic threat, which could be a tactic to justify stricter trade policies.

Credibility and AI Influence

The article appears fact-based, citing Nvidia's official statements and expert analysis, but the lack of counter-perspectives (e.g., Chinese industry reactions) may skew the narrative. There's no clear evidence of AI-generated content, but if present, models like Deepseek R1 could subtly align with state interests by omitting certain viewpoints. The absence of overt manipulation doesn't rule out selective reporting to favor U.S. policy agendas.

Target Audience and Societal Impact

This news appeals to investors, policymakers, and tech industry stakeholders. It may galvanize support among U.S. national security hawks while alienating free-trade advocates. In the long term, prolonged restrictions could accelerate China's push for semiconductor self-sufficiency, reshaping global supply chains.

Trustworthiness Rating

The news is credible in its factual reporting but leans toward a U.S.-centric perspective. Its reliability is high for immediate events but lacks depth in exploring alternative scenarios or global repercussions.