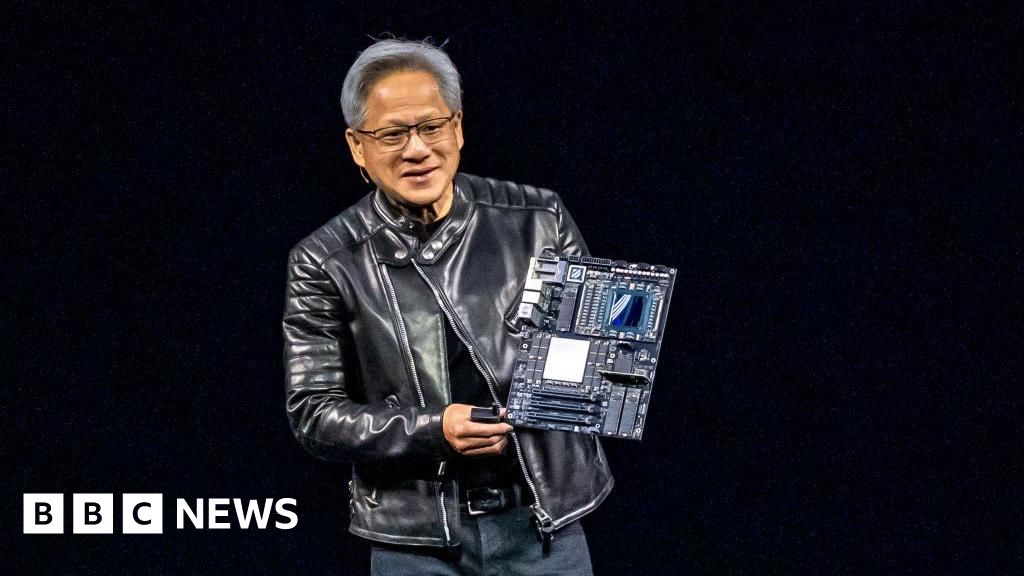

Computer chip giant Nvidia has once again found itself at the centre of US-China tensions over trade and technology. On Thursday Nvidia's chief executive Jensen Huang flew to Beijing to meet senior Chinese officials, just after the US imposed new export controls on its chips. The California-based company will require licenses to export its H20 AI chip to China, a move which the US Commerce Department said was designed to safeguard "national and economic security". Nvidia said federal officials had told them the requirement will be in force for the "indefinite future". But why is the company so pivotal in the race for AI supremacy between the US and China? Nvidia designs advanced chips, or semiconductors, that are used in generative artificial intelligence. Generative AI can produce new content from a user's prompt, like ChatGPT. In recent years, a surge in global demand for AI chips led Nvidia to become one of the world's most valuable companies. In November, Nvidia briefly unseated Apple as the largest company in the world by market capitalisation. Because its chips are seen as so essential to advancements in generative AI, successive US administrations have scrutinised Nvidia's relationship with China. Washington hopes the new export controls will slow China's development of advanced AI chips - especially their use by the Chinese military - and secure an advantage in AI competition with Beijing. US restrictions on Nvidia selling chips to China are not new. In 2022, Joe Biden's administration imposed separate export controls on the sale of advanced semiconductors to China. Nvidia specifically designed the H20 chip to comply with those existing restrictions. A more powerful Nvidia chip, the H100, was already banned for sale in China. However, the recent emergence of DeepSeek, a Chinese generative AI company, has prompted fresh concerns in the US that even less powerful chips could lead to significant technological breakthroughs. DeepSeek claimed it could operate as effectively as other applications like ChatGPT using less advanced chips. Now, there is increasing demand for Nvidia's H20 chips among Chinese technology companies such as Tencent, Alibaba, and ByteDance, the parent company of TikTok. Those companies have outstanding orders for the chips. But because there is no grace period on the imposition of the new curbs, Nvidia expects to be hit by losses of $5.5bn (£4.15bn) from these orders that it can no longer fulfil. Chim Lee, a senior analyst at the Economist Intelligence Unit in Beijing, told the BBC that there are alternative AI chips being developed in China, by companies like Huawei. Although they are currently viewed as inferior to Nvidia's, Mr Lee said the US curbs could prompt China to focus on developing better chips. "It will introduce challenges to China's AI scene, but it won't massively slow down China's AI development and deployment," Mr Lee added. China is a critical market for Nvidia. The world's second-largest economy accounted for 13% of its total sales last year, though that is still far less than the United States, which accounted for nearly half. The timing of Mr Huang's trip is being seen as an effort to shore up Nvidia's business in China despite the latest curbs. In his Beijing meeting with Ren Hongbin, head of the China Council for the Promotion of International Trade, Mr Huang said he hoped "to continue to cooperate with China", according to state broadcaster CCTV. On Thursday, the Financial Times reported that Mr Huang's trip to China also included a meeting with DeepSeek's founder, Liang Wenfeng. Separately, top Chinese official He Lifeng told Mr Huang that "China's market investment and consumption potential is huge", according to state news agency Xinhua. During talks with Shanghai's mayor on Friday, Mr Huang said he was committed to the Chinese market, according to a Shanghai government statement. The controls are part of Washington's broader goal to de-risk supply chains for advanced technology away from China, and bring more semiconductor production back to the US. Nvidia this week announced plans to build up AI servers in the US worth up to $500bn. US president Donald Trump later claimed his re-election drove Nvidia's decision. And in March, Taiwanese semiconductor giant TSMC, which manufactures Nvidia's chips, announced it would invest an additional $100bn in advanced manufacturing facilities in Arizona. Gary Ng, senior economist at Natixis, told the BBC the latest developments show that global technology is becoming increasingly polarised between "two systems", one dominated by the US and the other by China. "Tech will be less global in that sense, and it will be subject to more restrictions."

Nvidia: The AI chip giant caught between US and China

TruthLens AI Suggested Headline:

"Nvidia Navigates New Export Controls Amid US-China Trade Tensions"

TruthLens AI Summary

Nvidia, the prominent computer chip manufacturer, is currently navigating a challenging landscape amid escalating US-China tensions surrounding trade and technology. The company's CEO, Jensen Huang, recently traveled to Beijing for discussions with senior Chinese officials, just as the US introduced new export controls on its chips. These controls require Nvidia to obtain licenses for the export of its H20 AI chip to China, a measure intended to protect national and economic security as articulated by the US Commerce Department. This new regulation is expected to remain in place indefinitely, raising concerns about its impact on Nvidia's business operations in China, a crucial market that accounted for 13% of the company's sales last year. The imposition of these controls follows the Biden administration's previous restrictions in 2022, aimed at curtailing China's access to advanced semiconductors, particularly in the context of military applications. Despite these hurdles, Nvidia is still seen as a key player in the global AI chip market, given its pivotal role in the development of generative AI technologies, which have seen a surge in demand in recent years.

The recent emergence of Chinese generative AI companies, such as DeepSeek, has intensified scrutiny from US officials regarding Nvidia's exports to China, as they fear even less advanced chips could facilitate significant technological advancements. Consequently, Nvidia anticipates a financial hit of approximately $5.5 billion due to unfulfilled orders from major Chinese technology firms like Tencent and Alibaba, particularly for its H20 chips. Analysts suggest that while US restrictions may challenge China's AI development, they may also motivate the country to enhance its own semiconductor capabilities, potentially leading to the emergence of competitive alternatives. Huang's visit to China is interpreted as an attempt to reinforce Nvidia's presence in the market, with discussions highlighting the potential for continued cooperation. As the US pushes to relocate semiconductor production domestically and reduce reliance on China, the situation illustrates the growing polarization of global technology, with distinct systems emerging in the US and China, leading to increased restrictions and a less interconnected tech landscape.

TruthLens AI Analysis

Nvidia, a leading player in the computer chip industry, finds itself at the epicenter of the ongoing US-China tensions regarding trade and technology. This article highlights crucial developments in the relationship between Nvidia and both nations, particularly in light of new export controls imposed by the US government on Nvidia's AI chips, which could have far-reaching implications for the company and the tech landscape.

Strategic Importance of Nvidia in AI Development

Nvidia has positioned itself as a critical contributor to the generative AI sector, designing advanced semiconductors essential for AI applications. The company’s chips facilitate the creation of AI-generated content, making them indispensable in the race for AI supremacy between the US and China. The increasing demand for AI technologies has elevated Nvidia to one of the world's most valuable firms, reflecting its strategic importance in global technology markets.

US Export Controls and Their Implications

The recent move by the US to impose export licenses on Nvidia’s H20 AI chip to China is a continuation of a trend initiated by previous administrations. With the aim of safeguarding national security, these controls are intended to hinder China's military advancements and technological capabilities in AI. The article suggests that the US is intent on maintaining a competitive edge over China by restricting access to crucial semiconductor technology.

Concerns Over Chinese AI Advancements

The emergence of companies like DeepSeek in China, which is capable of producing significant AI technologies, has raised alarms within the US. The article indicates that even less powerful chips could lead to notable technological advancements, intensifying the scrutiny on Nvidia's sales to China. This context underscores the broader geopolitical implications of technology transfer and the race for AI capabilities.

Public Sentiment and Perception Management

The article may aim to shape public perception regarding the urgency of the US's actions against perceived technological threats from China. By emphasizing Nvidia's importance and the potential risks of allowing Chinese access to advanced chips, the narrative could be driving a sense of nationalistic urgency about technological leadership and security.

Potential Manipulation and Trustworthiness

There are elements in the article that could be perceived as manipulative, particularly in the framing of issues surrounding national security and technological superiority. By focusing on the risks posed by Chinese advancements, it may create an "us vs. them" mentality. However, the information presented appears factual and relies on known events and statements from officials, making it reasonably trustworthy.

Impact on Markets and Global Power Dynamics

The implications of this article extend into financial markets, particularly affecting stocks of technology companies involved in AI and semiconductors. Nvidia’s position and the regulatory landscape surrounding it could influence investor sentiment and stock performance in related sectors. Additionally, the ongoing competition between the US and China in AI technology could reshape global power dynamics, impacting not only economic relations but also geopolitical strategies.

Conclusion

This article serves to inform the public about the challenges Nvidia faces amid US-China tensions while highlighting the strategic significance of AI technology in global markets. The narrative advances a sense of urgency around national security and technological leadership, which ultimately aims to rally public support for stricter measures against perceived threats.